The Usermode Font Driver Host process is an important part of the Windows operating system. It may raise questions among users due to its high consumption of resources such as CPU and memory. Let’s find out what this process is and whether you can do without it.

What is Usermode Font Driver Host?

The Usermode Font Driver Host process, as its name suggests, is responsible for handling fonts in user mode, which helps the system display text in various applications and interfaces. The running process is usually located in the standard system directory C:\Windows\System32\fontdrvhost.exe. This process also handles requests from applications and programs that require font rendering services. Among the latter is everything from basic text display to complex font formatting in documents and web pages.

In recent Windows updates, when you try to find the fontdrvhost.exe process in Task Manager, you will see that it is running under the user name “UMFD-0”. This is an account for the User Mode Driver Framework, which restricts the process’s access to only working with fonts. This provides the security that recent Windows updates have brought. The UMFD-0 account ensures that the process does not extend to activities other than font manipulation.

Usermode Font Driver Host High CPU and Memory Troubleshooting

High consumption of CPU and memory resources by the Usermode Font Driver Host process may occur in several cases. First one is you are working with graphic editors, designing programs or loading a large number of non-standard fonts.

Alternatively, increased consumption also can be caused by incorrect operation or failure in the Windows font management system. When corrupted or incorrectly created fonts are installed in the system, Usermode Font Driver Host may consume an excessive amount of resources trying to process or fix them.

Problems with Usermode Font Driver Host may be related to a corrupted UMFD-0 image. There are a couple of ways to solve this problem – through running a system files’ scan, or by updating Windows. Let’s start with the least invasive one.

Step 1: Run System File Checker

Windows carries quite a few system recovery utilities that will be helpful with pretty much any situation. In the case of file corruption, a tool called System File Checker will be on hand.

- Open a command prompt as administrator:

Type cmd in the search box and click “Run as administrator” to open elevated Command Prompt.

- Type the next command “sfc/scannow” and press Enter.

- Wait for the scanning process to complete and errors to be corrected.

- Restart your computer after the scan is complete.

If System File Checker does not solve the problem, it may indicate deeper system irregularities. In such a case, it is recommended to update Windows to replace and update system files, which may fix existing system problems.

Step 2: Update Windows

Windows Update is an effective solution to the problem of high resource consumption caused by incompatibility or a faulty system module. Each Windows updates contain bug fixes and performance improvements that can solve existing resource consumption problems. Developers constantly analyze user reports and diagnostic data to optimize system performance. To check for updates, press the Windows key + I and choose “Windows Update.” If any updates are available, download and install them.

Step 3: Removing damaged fonts

As I wrote above, the fontdrvhost.exe may consume an excessive amount of resources to process more corrupted fonts. Therefore, remove fonts that have been installed recently or may be corrupted.

To do this, go to Control Panel > Fonts.

Then, remove fonts that fall under the following description:

- The font is not compatible with your encoding language

- Downloaded from unreliable sources

- Font is repeated several times

- Not used for a long time

Can I Stop or Disable Usermode Font Driver Host?

The Usermode Font Driver Host is a crucial component in the smooth operation of many Windows applications, due to its integral role in managing font rendering processes within user sessions. Given its importance, it’s clear that this system process should not be tampered with, as it is not harmful in nature. If you’re experiencing unusual behavior related to the fontdrvhost.exe process or any system instability, it might not be the process itself but rather an indication of other underlying issues—possibly malware.

Therefore, it would be wise to conduct a comprehensive system scan for viruses or malware to ensure your system’s integrity. A reliable tool for this task is Gridinsoft Anti-Malware. This software is designed to detect and remove malware, offering a robust defense against potential threats that could masquerade as legitimate system processes or exploit them to carry out malicious activities. Regular scanning with such a tool can help maintain your system’s health and safeguard against security threats.

Download and install Anti-Malware by clicking the button below. After the installation, run a Full scan: this will check all the volumes present in the system, including hidden folders and system files. Scanning will take around 15 minutes.

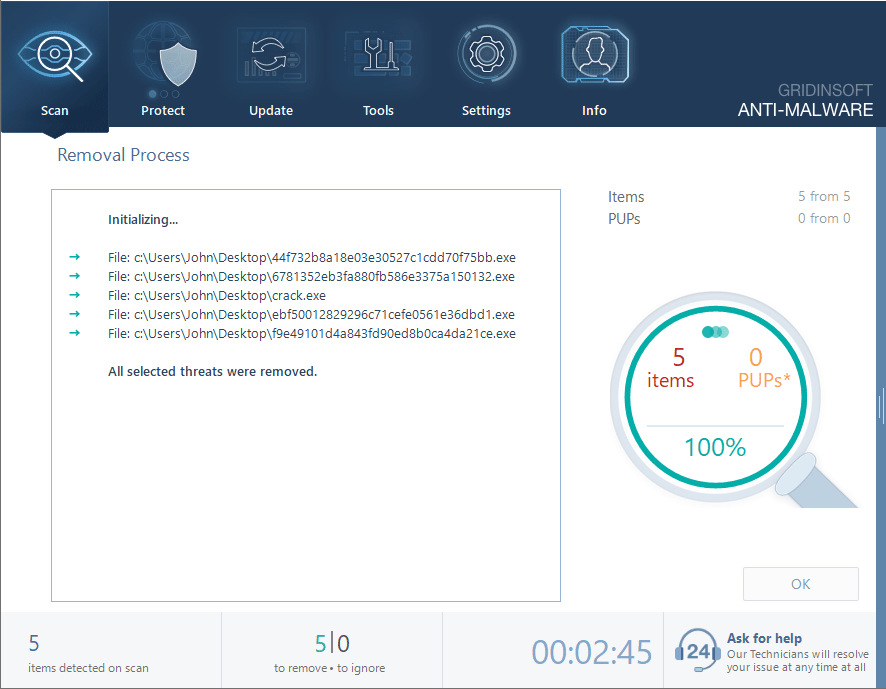

After the scan, you will see the list of detected malicious and unwanted elements. It is possible to adjust the actions that the antimalware program does to each element: click "Advanced mode" and see the options in the drop-down menus. You can also see extended information about each detection - malware type, effects and potential source of infection.

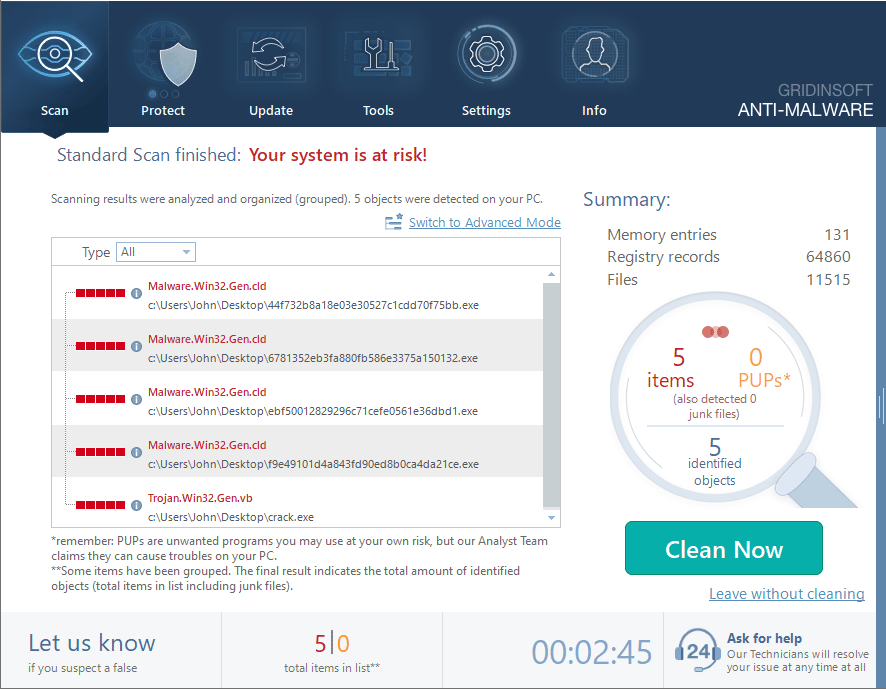

Click "Clean Now" to start the removal process. Important: removal process may take several minutes when there are a lot of detections. Do not interrupt this process, and you will get your system as clean as new.